Protocol Flow

A summary of the MANTIS protocol flow in different scenarios is below, with further details found in subsequent sections of this documentation:

1. Intent Submission:

- User-Driven Transactions: Users specify their transaction requirements, typically involving an exchange of a certain amount of one cryptocurrency (Token A) for another (Token B).

- Assisted Order Formulation: MANTIS assists in setting up order limits; in the example of exchanging A for B, MANTIS provides suggestions for the exchange amount of Token B. The exchange rate will not be less than the user-defined A/B ratio.

- Confirmation and Blockchain Registration: Users review, confirm, and sign their transaction details for blockchain recording.

- Timeout vs. Price Limits: A balance between price limits and matching times is maintained, with tighter limits possibly leading to longer wait times for order matching.

2. Order Execution Observation:

- Status Monitoring: Users can track the status of their orders post-placement.

- Possible Outcomes: Orders may be fully executed, partially filled, canceled, or timed out.

- Handling Partial Fills: Partially filled orders result in users receiving a portion of the requested amount, with the remainder being canceled or expiring based on the order settings.

3a. Single-Chain Execution Scenario:

- Efficient Execution: The platform swiftly matches orders in a single transaction block for prompt fulfillment.

- Batch Auctions: Batch Auctions process multiple orders simultaneously, maximizing the product of exchanged amounts (A * B) for efficient matching.

3b. Order Pricing:

- Dynamic Price Matching: The platform matches orders to achieve optimal trading volume without violating user-set limits.

- Execution at Optimal Prices: Execution occurs at a price that maximizes volume, ensuring efficiency.

4. Cross-Chain Execution Scenario:

- Multi-Chain Execution: Certain orders are executed using liquidity pools across multiple blockchain networks, involving several blocks and chains.

- Cross-Chain Virtual Machine (CVM) Program: The CVM facilitates these transactions, ensuring efficient multi-chain swaps.

- Monitoring Interface: A detailed interface provides real-time updates for multi-chain transactions.

- Cross-Chain Transfers: This includes straightforward cross-chain transfers.

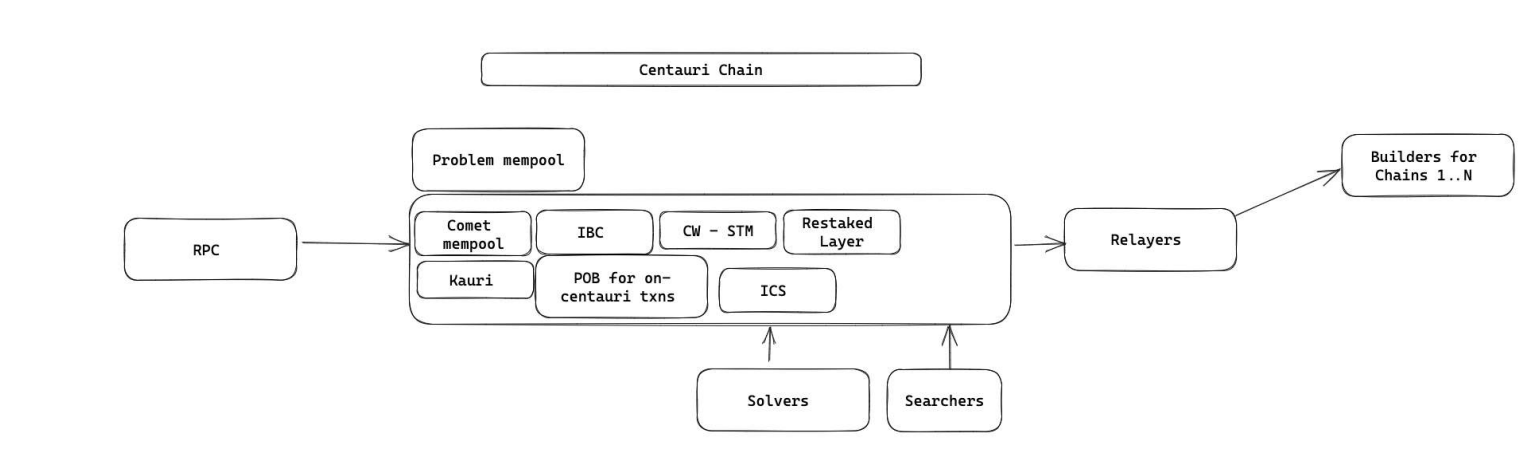

The above components are displayed in some form in the following architecture diagram of Composable’s Cosmos chain: